The market was known for everything from groceries to clothing and electronics.

The company directors of the market have gone into administration, forcing all traders to shut up shop with ‘immediate effect’.

This isn’t worded right, let alone a proper journalist’s assessment of the situation. First, the business has gone into administration, not the directors. Second, they haven’t dug in and provided any insight into why the indoor market business has gone into administration.

Given that it’s the stores themselves that pay the bills to the market, I can’t imagine that’s the reason. The business would put prices up, then the stores would close before the business does.

https://stratfordoriginal.com/news/farewell-to-market-village-in-stratford-centre This is the news article on their website. It also gives no significant information, but states:

We are working closely with the London Borough of Newham to understand the evolving situation

So what’s going on here? Who’s closing it down, a business or the council? Certainly, the website for the market doesn’t seem to be directly connected. If only there was an actual journalist looking at it…

Here is an article from 12 Jan, before it closed, rather than one reporting on the petition to bring it back: https://www.newhamrecorder.co.uk/news/24046578.stratford-centre-confirms-market-village-set-close/

Due to the administration of Stratford Market Properties LTD, we can sadly confirm the imminent closure of Market Village.

"Although part of Stratford Centre, Market Village is not owned by Stratford Centre and is operated as a separate entity.

According to The Gazette (a source for business details of those operating in London), the company Stratford Market Properties LTD was incorporated in 2019. Stratford Market has been around far longer than this. I smell something rotten.

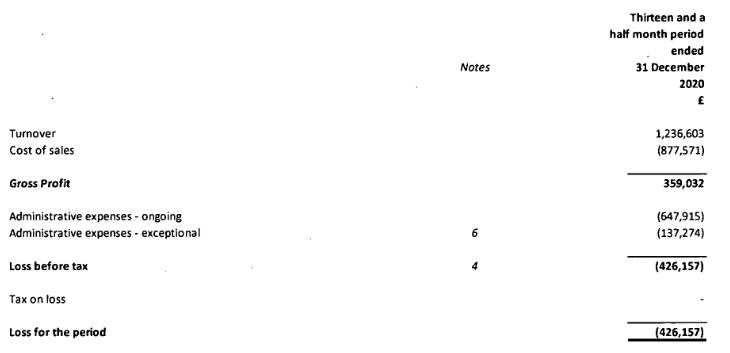

In their first 13.5 months of trading, up until 31 Dec 2020 (including most of covid) they made a loss overall - but only after “administrative expenses” of £785,189, equivalent to 63.5% of their turnover.

The most recent filing from Dec 2022 shows administrative expenses of £1.18M in 2021 (75% of turnover) and £511,743 in 2022 (41.7% of turnover). For some reason, in 2022 there was an “exceptional” administrative income of £67,601.

The balance sheets beyond those basic financials look far worse. There was a £2,442,577 debt recorded in the 2020 filing, which grew to £3,501,446 by 2022. However, this business only started in 2019 - how can a new business have more than £2M in debt when it’s only just starting??

Leveraged buyouts, that’s one way. You buy a company, but offer less than it’s worth (but more than half) and use the company’s credit rating to have it take out a loan and cover the rest of the purchase. The new owners take over, but the business is saddled with debt.

I have no idea if this is what’s happened here, but I wouldn’t be surprised. It’s what took down Toys R Us, I suspect it’s what happened with BHS and Debenhams, and it’s what’s happening to Twitter right now.

These rich fuckers are acting with criminal intent to cause harm to society, for their personal benefit.

Also, why the fuck couldn’t Ed Cunningham of timeout.com actually dig in and do the fucking job he’s labelled himself as having. This didn’t take me that long to type out on the fly - I may well have beaten him to publication if we both started at the same time. He should go back to making shitty low-effort J-pop music.

Edit: Also, just in case anyone thinks I’m doxxing the guy, all I did was click the name of the author on the OP website, then click the link in his bio on the website to his music page. I thought maybe his music might redeem him a little, but no.

After a few moments of shocked silence, one person in the audience starts slowly clapping. Soon others join in until finally everyone rises in a cheering ovation

I kind of want to dig deeper, too. However I don’t know where to start looking for who owned the property before 2019, or for details of the purchase. There’s only so much looking at financials I can do before I fall into reading financial regulations, and then I quickly start to lose the will to live - and I say that as someone who finds legal matters entertaining.

To answer your final question, if you read Ed’s biography on the site:

You’ll usually find him writing about culture, music, design, art, sustainability, travel and London.

I doubt he knows his way around a balance sheet - and knowing how TimeOut has been hollowed out, they probably can’t afford to send him on the Finance for Journalists 1 day course.

That is fair enough, sure. I have no real financial background or competence (lol credit score) but I maybe do have some insight how to process it.

However, even before I went into the proper financials, I quickly found another article that gave far better detail than he did. All he did was jump on the bandwagon of a bunch of people saying it had closed after the fact, the Newham Recorder reported that it was happening beforehand. This is something a real journalist should do, at the very least they should tease out the story and gain some understanding. Saying “the directors have gone into administration” suggests that he didn’t even try to get a grasp of the situation - his contribution was barely better than something AI could spin up.

I hope we get some sort of intervention here but I doubt it.

We won’t, I suspect this is a leveraged buyout. The purpose of which is usually to bring down a business by saddling it with debt. The motive is always obscure, but this being London I expect it’s to do with property development.

Property seems a bit unlike when the market operates inside Stratford shopping centre.

You’re probably right. I don’t really know how this works, or any detail beyond the articles I linked and the Companies House information I pulled up about the business that owns the property. Hell, I’m sure if an actual accountant looked at the filings and my comments they’d quickly put me in my place over something significant.

I’d be interested in poking into the previous owners and the 2019 sale of the property, but I don’t have any leads to start on that.

Sad news