You are now entering your spicy years. 🌶️

My office has quite a few fresh grads who own their own places.

Their parents bought it for them for a graduation present.

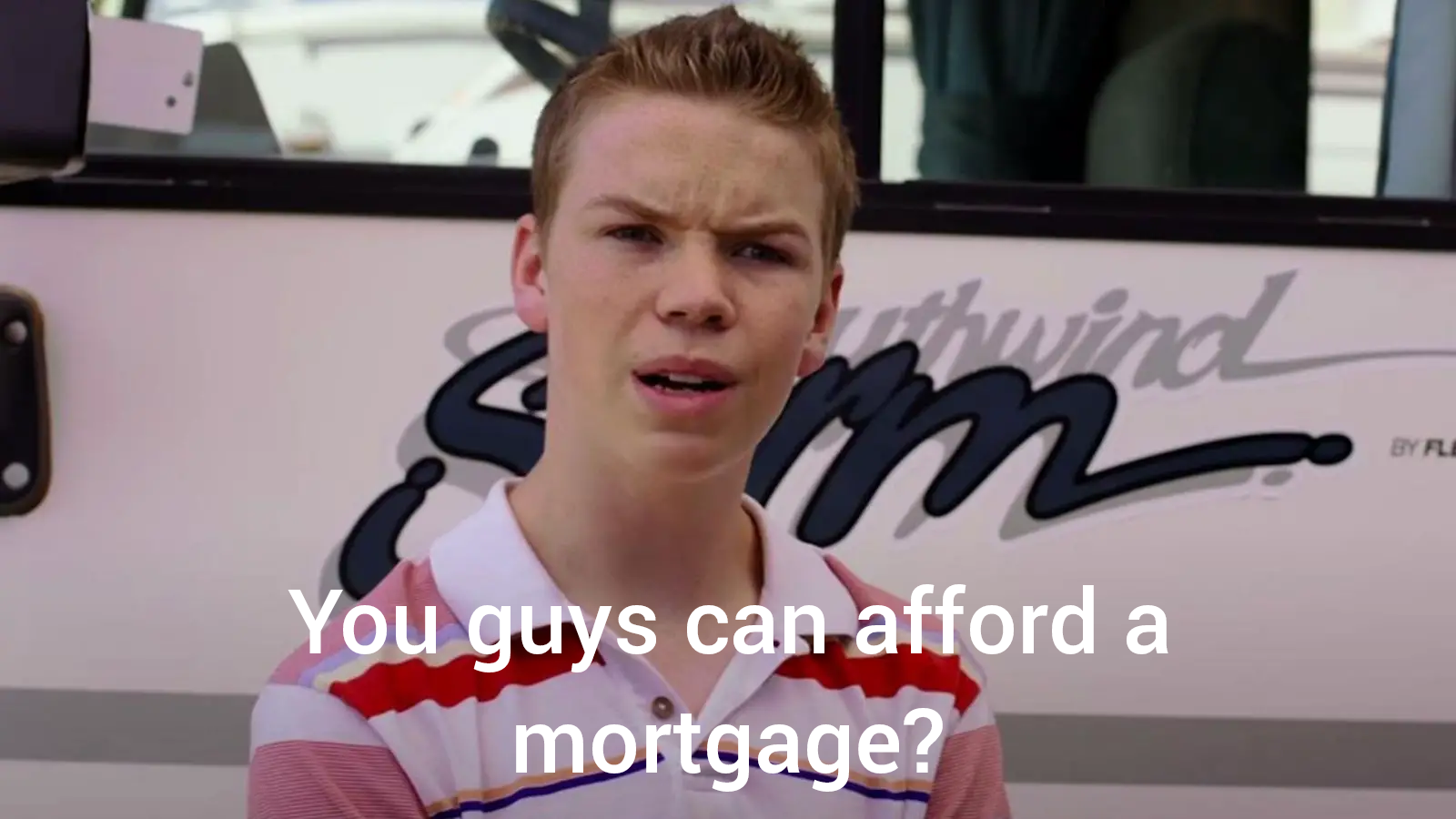

No no no see you pay a mortgage, but you won’t own anything.

Affording a mortgage is the easy part.

Then you have to somehow get your mortgage-contingent offer accepted by the seller when you’re up against cash offers, $50k over asking, with no inspection, no appraisal, unlimited possession, and a free hit of adrenochrome.

Mortgage payments are cheaper than rent

My wife and I were able to buy a ridiculously priced starter home only because we had the privilege of her parents being able to help with the down payment. We had to move farther away from work than where we were renting just to be able to even consider homes.

Our mortgage is twice what our rent was, and we only gained about ~100 sq ft of interior space. Plus a whole host of problems because the previous owners were jackasses who DIYed everything and did it all wrong.

You get 0% back when you move out of an apartment. It is much more expensive to rent than own considering this, even if you sell at a loss. Only a portion of your mortgage payment (interest) won’t be able to be recouped, whereas all of the rent is gone forever.

You incur interest and fees with a home that you pay in addition to your principle. It can be seven years or more before you begin actually storing any value in that purchase because it’s eaten by the cost of borrowing.

It depends on your time horizon and relative costs of overhead and rent. NYT has a great new rent vs own calculator that really opened my eyes to how long it takes to build home equity.

That fucking sucks, but don’t apply your anecdotes as general truths. I have the opposite experience.

Wife and I built a new home with family help on the downpayment. Doubled sq ft, 1.5x previous rent, house increased value significantly between contract and move in. Farther from work but closer to highway so commute times unaffected. Saved up enough to pay back the downpayment help over the course of a year.

I’m a massive outlier, and most people have experiences closer to yours, but it’s not an across the board thing. So fucking much of the housing market depends on location.

So you got a zero percent loan requiring no collateral for a piece of land? I’m happy for you, but you do realize how few people that’s available to right?

no shit cry baby. guess you only seen “zero interest loan” and not MASSIVE OUTLIER

Look I’m happy for you, but I’m from an area where this is all very different from where I ended up.

Im sorry, but I do think thats a massive part of this conversation. There are plenty of places where housing is still affordable, but relocation is a thing, and more importantly, so is the tie to pensions funds and investment in major metros.

All of that to say, I’m glad to say it worked out for you and yours, but it’s just not relevant in this conversation, at least as long as social security requires people changing tires in Atlanta Georgia.

You thought college radicalized people? Renting and student loans will have them on the verge of revolution.

I’m just waiting for people to start filling the streets

Sorry, streets are full. No vacancy here

don’t know where you live, but where i live people love whining about how they can’t afford rent while they go on $5000 international vacations every year.

one of my ex-friends who is a trans anarchist, just did this. they work part time in a bike shop, and yet they can afford a two week long tour of Taiwan. But they will talk your ear off about how landlords are evil and the revolution is coming because they can’t afford their rent in one of the nicest areas in my city. irony.

And what country are you in?

Sure.

Gen Z owns homes at higher rates than millennials, x’ers, and boomers.

https://www.economist.com/finance-and-economics/2024/04/16/generation-z-is-unprecedentedly-rich