I am trying to make a decision. curious about your thoughts on my personal situation, and what you think in general. or your own stories if you have anything relevant…

Live within your means.

Cheap yes, shitty no.

Living in a shitty place to me means potentially unsanitary (broken, moldy) or unsafe neighborhood/building. Cheap on the other hand might mean well out in the suburbs or a generally less desirable/boring area. That’s something I feel like a compromise is possible.

Struggle to afford is also a bit of a vague statement. Can you give us an idea? There have been some ratios going around like rent should be max 30% of your income for example, but I don’t really get why you shouldn’t go beyond that if your remaining expenses are manageable.

So before sacrificing safety, I’d rather do a proper budget and check if there’s a chance to save money elsewhere to make a nice place more affordable.

Renting: cheaper is almost always better.

Purchasing: it can make sense to get the nicest place you can afford, with the expectation that your pay will increase but your mortgage won’t.

I would argue living below your means is always better. Getting a cheap mortgage you can add an extra $100 or $200 a month to for the first five years makes a TREMENDOUS difference in how much interest you pay over the life of the mortgage and how soon you own it. The first five years of a mortgage are so important, all your payments go to interest. I’ve turned all my 30 mortgages into 15-20 year mortgages by over payments and it’s served me extremely well.

It depends on where your priorities are. For me i would go for cheap\shitty place so long as it was safe enough and i wasn’t going to be robbed all the time. Save the money and then go buy a place you really like when you can afford it better.

so long as it was safe enough and i wasn’t going to be robbed all the time

Want to emphasize this. You end up losing based on stolen goods or physical harm.

Generally the cheaper place, imo. One big thing to consider is your commute though. The quality of the place itself has some impact on your overall happiness for sure, but length of commute really has a lot more than you’d expect. If the cheaper place is a lot farther away, not only will that eat up time, but you’ll spend extra money on just commuting, which will eat into the amount it actually saves you.

Not more than a third of your income, is the general rule

In many cities, that would mean a 81sqft room in a unit with three roommates in the worst part of town, and having a 45 minute commute to work (each way).

Life’s too short, is what I decided. I could live in almost comfortable conditions and not have any money, or live in miserable conditions and still not have any money.

The room I am looking at is literally that 🥲 81 sq feet and a 55 min commute to work.

Rent a cheap, shitty place

Save the money until you can afford to buy your own home.

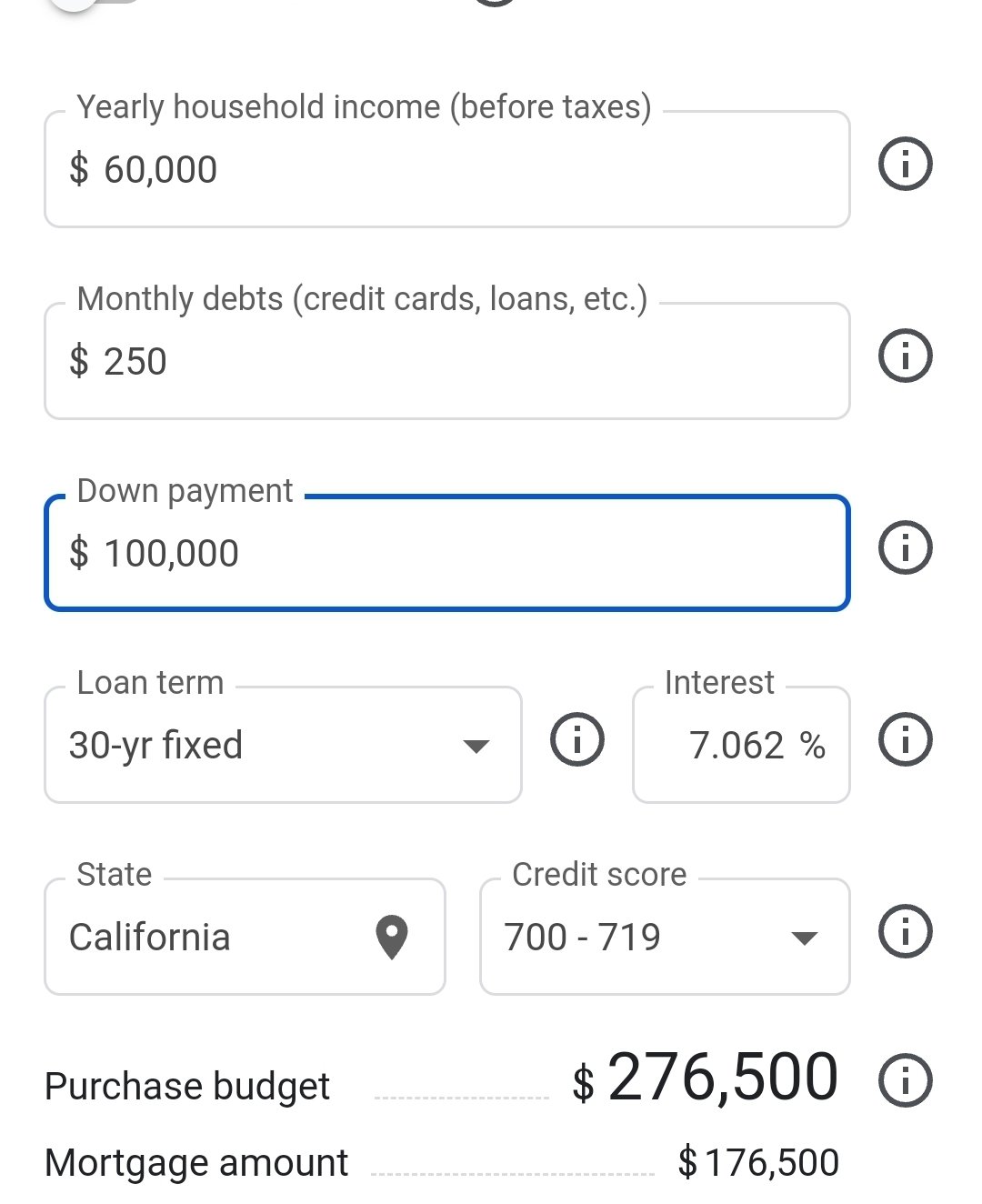

Ah, I don’t think I will ever be able to afford a house. My income isn’t likely to increase by much given my career (80k might be my max, 100k is possible in a decade or two or if I get a PhD). Houses average around 800k. Not to mention the risk of fire, in the region, it doesn’t seem like a sound investment for someone at my income.

So for me, my financial goals are about building up retirement fund and being able to afford a better life (my dreams are to pay for fluff/fold laundry because I have ADHD and constantly struggle keeping up, be able to afford to travel without dipping into emergency fund, have my car paid off, be able to afford car repairs without dipping into emergency fund 😭. just basic stability.) I don’t plan on having children, and honestly don’t particularly care about marriage and prefer a lifestyle of a robust community life.

So what good is a house for me? I have read all the financial advice recommending it but … that seems to apply more to people with families, or higher incomes where saving to buy a house requires less sacrifice from daily life. It doesn’t seem like a good use of my money. Scrimping for twenty years, only to still pay off a mortgage for thirty years, and then die.

Sounds like you’re just making excuses for your lack of willpower.

If you’re able to pay for rent, you’re able to afford paying back a loan.

Imagine building a retirement fund and then pissing it half of it away because you’re still renting lmao.

If you’re able to pay for rent, you’re able to afford paying back a loan.

May not be true depending on where OP lives. There are a lot of rent vs buy calculators out there, and home prices are so expensive in some areas that it’s actually better financially to rent instead of own, and to invest the difference in payments. For example that’s the case where I live in San Francisco - investing the difference between rent payments and mortgage payments nets me more in the long run, even considering housing value appreciation.

Edit: this of course doesn’t apply to investment properties, where you get the value of the asset + appreciation, but also get rental payments.

List of things you can do if houses are too expensive where you live:

- move.

- rent, invest the difference, enjoy $$$

- reach retirement age, still piss away half your income in rent, never improve your life.

Improve your life by moving to a shithole rural area where houses are cheap?

Lack of willpower? Lmao where is that even coming from? Sounds like you just wanted to bring up your talking point?

I work a full-time job and am doing very well for my field given my years of experience … it’s just not a high paying job, because I work for an environmental nonprofit and the work itself is important to me. Are you just saying that because my dream is to not do laundry? What is the point of having money if you can’t use it to save yourself hours of labor? And a couple hundred dollars a month on laundry would not make or break affording a house, anyway…

I can’t pay for a loan until I can afford a down payment. You need money for that.

You are clearly not a serious person, and I will lot be taking any of your advice seriously. You are not willing to seriously engage in the reality of my situation, and would prefer to live in a fantasy land where people are wealthy/poor due to “laziness” and not … exploitation. Because that is what is happening. I have a moral conscious and am being exploited by the nonprofit-industrial complex, being underpaid to do impactful work during a climate emergency.

edit: also, I’m already 30. by the time I could afford a down payment, I’d already be close to retirement age. Clearly you have never once thought about someone with a different financial situation to your own, and just think you’re better than anyone else who doesn’t live exactly like you do. Fuck off.

“you are not a serious person”, says the guy thinking pissing away their money in rent because they are too lazy to do laundry is a good tradeoff lmao.

You’ll be funding someone else’s property all your life like a servant just to save 15 minutes of folding clothes every week.

Oh shit, must have forgot that $200/month could buy me a house. Damn. Also don’t see where I mentioned that as anything other than an aspirational splurge. Also … it takes me way longer than 15 min to do laundry, esp because I have ADHD and a hard time keeping track of timing loads, and folding usually takes up to an hour. But I realize you’re too fucking dumb to know what a disability is.

Not to mention… what is the point of owning a house I’ll be paying my mortgage off on until I die? I’m gonna bring the house to the grave?

You’re renting, you can literally grab a truck and move to a cheaper housing market with all your belongings overnight.

If you can pay rent, you can pay a mortgage.

At least the mortgage is benefiting you.

You can’t pay a mortgage until you have a down payment … and even with a down payment…

Do you know what house I could afford for that much in my area? A house in a trailer park where I would still be paying rent.

You’re acting all superior but you literally can’t handle basic math.

And you’re saying I could just move to another area … I don’t want to. As an trans person, I will simply not be leaving. It is very easy to access healthcare and services in my area. And my quality of life would tank even if I wasn’t trans … my job is tied to living where I do, most of my community is here… anywhere I could actually afford would not be a pleasant place to live. But yeah, if you want to own a home in bumfuck Idaho, sure. I won’t be, because I think enjoying my life is more important than a deed.

My situation:

current place: ($1530)

- 1:15 drive from work

- small building, linear studio apartment shape, maybe 30x9 feet? small kitchen/bath

- rural, 20 min drive from city, hour walk to nearest town

- finished interior, but mice/rat problem

- landlord kinda weirdly tracking my movements, she doesn’t want me working from home too many ways a week

cheaper place: ($600)

-

55 min from work -standalone MIL in a shared house, bath/kitchen in main house, 9x9 feet

-

more suburban, roads might be too dangerous to be walkable but if not, maybe 15 min walk to town

-

unfinished interior… no idea if there is a mice/rat problem but the kitchen area is separate.

-

got along well with potential housemates

I make $3780/mo after taxes, budget now feels tight, but not sure if the extra $1000 a month would be worth a smaller/unfinished space. I feel it might be worth it because I could save/invest extra money, or use extra money to make the rental nicer.

Of your available options, I would definitely go with the shared housing. That’s a great deal for your area and for your income. You could actually save/invest money.

And to the people pushing on you because you rent, oh my God what the heck? I hate housing as an investment, we bought a house but it’s so expensive to maintain and the taxes and insurance, having somewhere to live for $600 a month seems like a great deal, take it.

I would hate the hour long commute, personally. Very sensitive to commute time. But if you are already doing it and don’t mind, that’s a separate consideration.

how the fuck is you working from home her problem ? In my euro shit country she wouldnt even dare saying something like that

I agree 🤷🏻♂️ she is concerned about me using too much of the well water. Landlords in the US have too much power.

I’m failing to see what’s wrong with the cheaper place.

It’s moving from my own place to a shared space, and I have to go outside to another building to use the kitchen or bathroom.

OK. Yeah. Those are sacrifices. Shorter commute and no pests? Huge upgrades though. It sounds worth it, unless you really really value your privacy.

Commute of fifty minutes? The max for me.

And I feel something like pests would be a great reason to spend more on housing. But in this case spend less.

Definite market failure there are not more housing options at more price points in more locations and quality.

unless you really really value your privacy.

OP’s privacy is currently being violated by the landlord keeping an eye on how many days they work from home. (wtf?)

Heard - unfortunately no pests isn’t a guarantee, it’s more of an unknown. The floorboards are unfinished and I wouldn’t be surprised if there was something.

Yeah the housing market here is rough. Only found this cheap place through contacts.

I don’t think unfinished floorboards necessarily makes rodents so much more welcome.

I’d say go for the cheaper one. You save 50 minutes every day, you probably don’t have to deal with rats any more, you can invest $1000 per month for savings, and you get rid of your creepy landlady. Flatmates might be a blessing and they might be a curse, but a good first impression is a start.

I’m definitely leaning this way. Messaged the shared house to let them know my interest, it’s still up to them but I’ll see!

And tbh I need to trust my instincts more. Got a weird vibe from the landlady from the start. So maybe it’s a good sign for the potential housemates 😅

Also finding it through contracts is a good sign.

If it’s not 100% cozy, remember you could spend $500 per month making it cozier and you’d still be in the green.

Good luck!

You should only even consider the latter if your employment is very secure and you’re a full-on homebody.

Being able to save now means a nicer place later; spending less on housing means more for going out. Get the cheaper place for a little while.

My employment is very secure and, I’m a homebody mostly just because there is nothing nearby for me to do other than nature, and I do nature for work … and I don’t have much money to go out 🥲

Sounds like you’d like to go out. Get a cheaper place and use the difference for adventures!

Shitty place. Save money, see what you can live with for 5 years, and then buy a house with your new lower standards.

Honestly, all the “luxury” apartments in my area are super fucking cheap(ly made) and charge out the ass for the word “Luxury”. Best rental experiences I’ve had are from direct owners, or mid size local companies, renting out an established building that isn’t old, but isn’t new, think 70s to early 90s in construction year.

Buying a house is a real paradigm shift. My monthly housing went from 1500 a month to 2500 a month, but at least I’m not throwing money in a hole. Take any money you save renting, and put it towards a house, or invest it, otherwise you are falling behind.

As I keep saying to my partner, the defining line for millennials, between the haves and the have-nots is going to be owning a home. For boomers, it was having a college degree, for Gen X, it was having investments. The best I can hope for is a few thousand ft^2 to call my own.

The luxury apartments are all well out of my price range, anyway … those tend to be $2k.

Housing is way too expensive in my area for it to be a good investment. Another commenter explained below, but housing is so expensive here that it is potentially better to invest money rather than buy a house. To even be able to afford $2500 a month… that’s like $100k salary?? If I did that at my salary, I would stop being able to afford basic necessities … any emergency health/repair funds would be financially catastrophic, and it would not be worth the hit to my quality of life. Not to mention you need like 100k just for a down payment. You see my income… if I took the cheap rental and invested my savings it would still take 10 years to make that, at which point I would be 40 years old and the houses would probably cost even more. I’d have to work until I was 70 with the typical 30 year loan. You must realize that this financial advice is very entitled.

But yes, I agree that investing the money I save through cheaper housing would be a good move.

The millenials I know who own a home all have support from their families, anyone else I know who is even close to being able to afford a house has VA benefits. Although I and my friends are all younger millennials. The cohort encompassing people in their late twenties as well as people in their early forties means it’s kind of useless for a lot of generalizations. Younger millennials/Gen Z are increasingly unlikely to afford a home.

2x ~50k salaries. ~13k in down payment+closing costs, and some creative accounting.

But yeah, no amount of sugarcoating is going to sweeten the deal.

Younger millennials/Gen Z are increasingly unlikely to afford a home.

This is exactly why a home is going to be the defining line of the Haves and the Have-nots.